Bonds

Stock investing is risky business, so what can you do to protect yourself?

Global bond markets are about twice the size of global stock markets for good reasons.

At the start of the Iraq war in 2003, Dick Cheney had about 25% of his impressive hundred million dollar portfolio in international bonds, including many French Government Bonds. Keep your eye on Dick. Another thing you can do is prepare for the worst. I would say the worst is a Weimar Republic type of meltdown. I don't believe it's gonna happen, but we're gonna have to be careful not to tempt fate with too much more "patriotism". If it does happen, then there's not too much you'll be able to do to protect yourself this time around, so don't spend too much time worrying about it.

Regardless, what are the implications for US investors? If we can avoid a global economic meltdown, and if we can avoid a global nuclear holocaust, then I would guess (and that's all anyone can do) that the prospects for US investors are as good for the future as they have been for the last fifty years. That means that you can expect declines of 50% or more in the US and global stock markets in the future AND you can reasonably expect advances of 50% or more. If we are all lucky, the advances will be greater than the declines. Stock investing is risky business and all of us are well aware of that fact right now.

I wrote that Dick Cheney put about 25% of his impressive hundred million dollar portfolio into international bonds, including many French Government Bonds. How good a move was this? The answer is that it depends on when the bonds were purchased. International bonds are currently primarily Euro denominated bonds. At the end of 2001 a US dollar would have purchased 1.12 Euros. At the end of 2007 a US dollar would have purchased 0.68 Euros. That means the US Dollar lost close to 40% of its value during that period. It also means that international bonds were an incredibly good investment.

Should international bonds be in your portfolio?

Here are some return data:

All returns are TOTAL RETURNS for the FIVE YEAR period ending June 30, 2006

Vanguard Intermediate Term US Bond Fund (ticker VBIIX) 26.8%

T. Rowe Price International Bond Fund (ticker RPIBX) 57.3%

How risky are international bonds?

The Vanguard Intermediate Term Bond Fund (ticker VBIIX) returned 83.7% over the TEN-YEARS ending June 30, 2006. The T. Rowe Price International Bond Fund (ticker RPIBX) returned 57.6% over the same ten-year period, meaning it returned almost nothing for the five-year period ending June 30, 2001

Most folks buy bonds for income AND they buy them to reduce the risk of a portfolio. I have rejected international bonds for my personal portfolio because they generally do NOT provide income equivalent to US bonds, they are considerably more risky than US bonds, and the expenses are considerably higher than a Vanguard bond fund.

Should you buy individual bonds, or should you buy a bond fund?

I have done considerable work in this area and I cannot think of a good reason to buy individual bonds instead of a well-managed bond fund with ultra low expenses. If you know of a good reason to buy individual bonds, then please share it with me. Individual bonds present a host of challenges for the do-it-yourself investor. First of all, buying individual bonds can be expensive. With very few exceptions, bonds are not listed on an exchange. To trade, you must get quotes and execute orders through a broker.

The initial investment in a bond fund, on the other hand, is typically much smaller than purchasing an individual issue, but with that lower price of admission actually comes greater diversity. A bond fund, which typically holds hundreds of different issues with different maturities, will inevitably offer greater protection against non-payment of interest and outright default than most individual investors could achieve on their own.

In addition to the advantage of diversity, open-ended bond mutual funds also have greater liquidity than individual issues. Redeeming shares in a bond fund is much easier than selling an individual bond. And investors who do not need cash flow benefit from bond funds because dividends can be reinvested automatically.

Should junk, or hi-yield bonds be in your portfolio?

Most successful investors practice some form of risk management. An easy way to manage risk is to allocate assets to both stocks and bonds because nobody knows if stocks or bonds are going to out-perform in the near or far future. If stocks go down, then prudent investors buy more and vice versa. The problem is that you need money to buy anything. If stocks go down and if you hold a bond fund, then you can sell some of the shares of the bond fund to buy more stocks. So the first question is: What would you rather hold during a decline: junk bonds or hi-quality bonds?

During a modest decline, the supply of money available to business is generally going to increase because corporations are reluctant to borrow money. Intermediate and long-term interest rates are generally going to fall as a response to the increased money supply. The Fed generally helps by reducing short-term rates to encourage this virtuous cycle. That means, all other things being equal, the principal value of a bond fund is going to rise.

But all other things are almost never equal because many bonds are going to default during a decline. Most of the defaulting bonds are going to be junk, so the principal value of a junk bond fund is going to be compromised much more than the principal value of a hi-quality bond fund. Even if bonds do NOT default, there may be a crisis in confidence which may result in a flight to safety. No one knows exactly what a flight to safety ultimately means, but during the global crisis that manifested itself most severely during the fourth quarter of 2008, it meant that investors abandoned almost everything except US government bonds.

What about the growth phase? During a growth period interest rates are going to rise because corporations want to borrow money to expand. That means the PRINCIPAL value of ANY bond fund, including junk, is going to tend to decline. That’s good, because a prudent investor will be taking profits by selling stock during this phase because stocks will have risen in price. So, what should you, as a prudent investor, buy? If you buy junk, and if the economy stays healthy, then stocks will almost certainly out-perform junk. If the economy declines, then hi-quality bonds will almost certainly out-perform junk. Hmm, I wonder why it’s called junk.

Recommendations

Before the 2008 meltdown I recommended a bond portfolio consisting exclusively of the Vanguard Intermediate Term Bond Index Fund. Unfortunately, during the height of the crisis in November 2008, the Vanguard Intermediate Term Bond Fund lost principal value while interest rates were falling. However, Short, Intermediate, and Long Term Treasuries all rose in value during this crisis, as did Government National Mortgage Association (GNMA) bonds. So, as long as the government doesn't devalue its currency completely, that means that the best vehicle to own during a crisis is one the government controls, because the government prints money. There is, of course, always a chance that the government will devalue its currency completely, but I do not believe there's too much a normal person can do to protect oneself under these circumstances, so I am not going to consider alternatives.

In December 2008 the Vanguard Intermediate Term Bond Fund bounced back, but the lesson learned from this crisis is that the best bonds to own during a crisis are the bonds that are sold by the folks who print money. The following bond portfolio did well during the 2008 crisis, but it probably won't outperform the Intermediate Term Bond Index Fund or the Investment Grade Corporate Bond Fund during the good times:

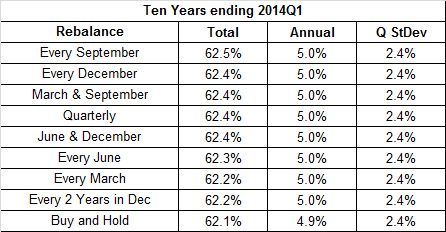

Here are the results of all the rebalancing strategies I back tested over the last 10 years for the Five Asset Bond Portfolio shown in the table above The data below show that all the various rebalancing strategies had an insignificant impact on the portfolio.

The bottom line is that it will be difficult to outperform the risk adjusted return of a well managed intermediate term bond index fund under normal economic conditions, but a good case can be made for the inclusion of US Government debt because it will (probably) perform well during a crisis. That assumption is valid only if the US Government does not completely devalue its currency. Once again, if that does happen, then there's not too much you'll be able to do to protect yourself this time around, so don't spend too much time worrying about it.

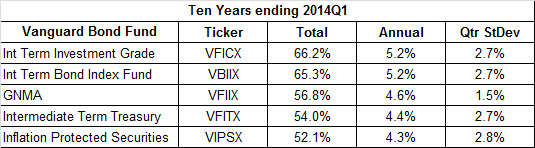

The Buy & Hold return of the individual bond funds is shown in the table below.

A Wall Street Journal article by Silvia Ascarelli published on May 8, 2016 reported that Burton G. Malkiel, the author of A Random Walk Down Wall Street, believed that “smart beta” was simply smart marketing.

I agree with Malkiel that “smart beta” is simply smart marketing, but that same article also reported that Malkiel made a recommendation to replace bonds with high dividend yielding stocks in his most recent edition (Eleventh) of A Random Walk Down Wall Street, which was published Dec. 29, 2014

From page 321 of Amazon’s Kindle

A Random Walk Down Wall Street 11th Edition Dec. 29, 2014

“EXERCISE 7A: USE BOND SUBSTITUTES FOR PART OF

THE AGGREGATE BOND PORTFOLIO DURING ERAS OF FINANCIAL REPRESSION

(Blah, blah, blah ...) One technique to deal with the problem (of

low bond yields) is to use an equity dividend substitution strategy

for some portion of what in normal times would have been a bond

portfolio. (Blah, blah, blah ...) I (Burton G. Malkiel) recommend

such a partial substitution of stocks for bonds in that part of the

portfolio designed for lower risk and more stability.”

For whatever it’s worth, I (Henry Wirth) and most others who expressed their opinions online believe this is a terrible idea because an enormous amount of research has been conducted to demonstrate that when stocks decline (especially during a crisis), then high dividend yielding stocks decline too, but high quality bonds generally rise (especially during a crisis). Furthermore, replacing bonds with high dividend yielding stocks violates the diversification precepts of Modern Portfolio Theory. These precepts demand assets with negative correlations in a portfolio for optimal results.

One year after the 11th edition of Random Walk was published, Malkiel wrote the following in another Wall Street Journal article on Dec. 30, 2015 titled Investing for 2016 in an Expensive Market.

“Bond investors should resist the temptation to sell all their bonds to avoid price declines as interest rates rise. The rise in rates is likely to be less sharp than some investors fear, and excess capacity world-wide will probably keep a lid on inflation for some time. Moreover, bondholders who reinvest their coupons and replace maturing bonds with higher yielding securities will find that rising rates will ultimately be beneficial.”

For whatever it’s worth, I agree with Malkiel’s second recommendation, but the first one is nonsense. Academicians lead charmed lives; they can apparently contradict themselves without compromising their reputations.

Returns of key assets during the 2008

financial crisis

over the twelve months ending December 31, 2008:

Vanguard 500 including dividends lost 37.0%

Vanguard Equity Income incl dividends lost 30.9% (Malkiel’s “safe”

investment)

Comment:

Stocks are guaranteed to go down in a crisis.

That makes them inappropriate investments for the “safe” part of a

portfolio.

Vanguard High Yield (Junk) Bonds including

dividends lost 21.3%

Comment:

Junk bonds are guaranteed to go down in a crisis.

They have a positive correlation to stocks during a crisis, and that

makes them inappropriate investments for the “safe” part of a

portfolio. And, if interest rise during a bull market, then they

will probably decline in value. That makes them an inappropriate

investment for the “dangerous” part of a portfolio. Don’t buy junk!

Vanguard Investment Grade Intermediate Term

Corporate Bonds lost 6.1%

Comment:

Investment Grade Corporate Bonds will probably decline during

a severe crisis,

but they MAY gain value during a minor correction.

Vanguard Intermediate Term Bond Index Fund

including dividends gained 5.0%

(The Int. Term Bond Index holds about 50% Corporate & 50% US Gov.

debt)

Comment:

A reasonably good compromise for the “safe” part of a portfolio, but

not as “safe” as the instruments that are sold by the folks who

print money.

Vanguard Intermediate Term US Treasuries

gained 13.3%

Vanguard Long Term US Treasuries gained 22.5%

Comment:

Debt that is guaranteed by a government that prints its own money is

the best debt to own during a crisis, but only if that same

government’s fiscal policies are good enough to preserve investor

confidence. We’ll see ...

What’s next for global investors?

Will we really get a recovery, or will stocks slowly decline over the next 10 or 20 years while they undergo the same volatile corrections and rallies that our Japanese counterparts experienced?

Unless that question can be answered with a high degree of certainty, a 100% stock portfolio is generally totally inappropriate, but a 50% bond and 50% globally diversified stock portfolio that’s rebalanced annually will almost certainly perform satisfactorily, and it will always give an investor a higher risk adjusted return than a 100% stock portfolio.

Revised Jan 2009, Oct 2013, May 2014, May 2016