Gold and Precious Metal

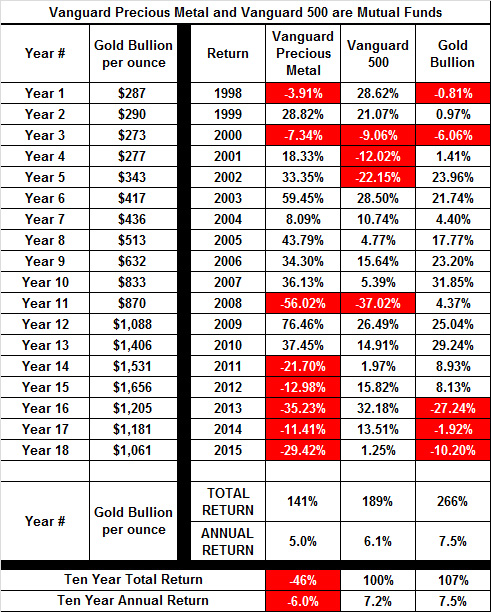

The data in the table above show that since 1997 gold bullion returned considerably more than the Vanguard 500 Index Fund.

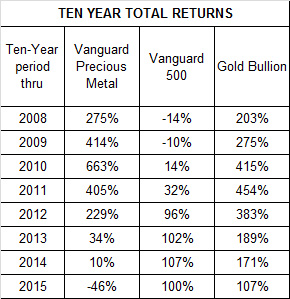

Furthermore, the table below shows that gold bullion returned considerably more than the Vanguard 500 Index Fund during almost all the rolling ten year periods since 2007.

Are the ten-year periods shown in the table above typical of the long term performance of gold bullion and the US stock market?

Definitely not, but past performance is not a valid

indicator of future performance.

If it were, then investing would be easy and everyone would be rich,

and that is clearly not possible.

That answer is based on more than eighty years of performance. That’s why limiting the gold and/or precious metals in your stock portfolio to 5% of the total is generally recommended.

However, intelligent and knowledgeable investors also know that the US version of capitalism is a system that always operates on the threshold of failure, meaning the limits are always tested. Frequently the limits are exceeded, and when they are, gold and precious metals will almost certainly outperform stock.

Since the beginning of modern financial history circa 1926, there have been three severe crises during which gold bullion outperformed stock by significant margins.

1. The Great Depression that began in 1929

2. The Great Inflation of the 1970s

3. The Great Depression that began in 2000

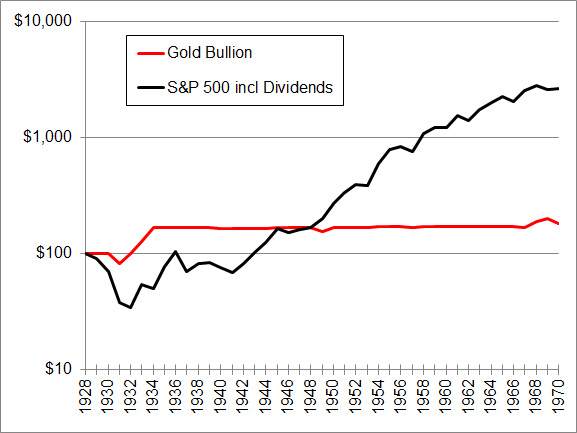

The chart below shows the performance of the US Stock Market (including dividends) and the performance of gold bullion from 1928 thru 1970. I used Robert Shiller (http://www.econ.yale.edu/~shiller/data/chapt26.xls) as the source for S&P 500 index values from 1926 thru 1944 and I used Shiller's Earnings per Share and Dividends per share from 1926 thru 1970. Prices for gold before 1970 were taken from Timothy Green's Historical Gold Price Table.

From 1928 thru 1970

Gold returned 81% and the S&P 500 including dividends returned 2,564%

Note that the Great Depression of 1929 occurred during the period shown in the chart above.

Once again, gold will almost certainly outperform stocks during critical periods of economic

uncertainty.

The Bretton Woods system was created towards the end of World War II and it involved fixed exchange rates with the U.S. dollar as the key currency, and it also linked gold to the U.S. dollar at $35/ounce. By the early 1960s, the U.S. dollar's fixed value against gold was seen as overvalued. A sizable increase in domestic spending on President Lyndon Johnson's Great Society programs and a rise in military spending caused by the Vietnam War gradually worsened the overvaluation of the dollar. On August 15, 1971, US President Richard Nixon announced the "temporary" suspension of the U.S. dollar's convertibility into gold.

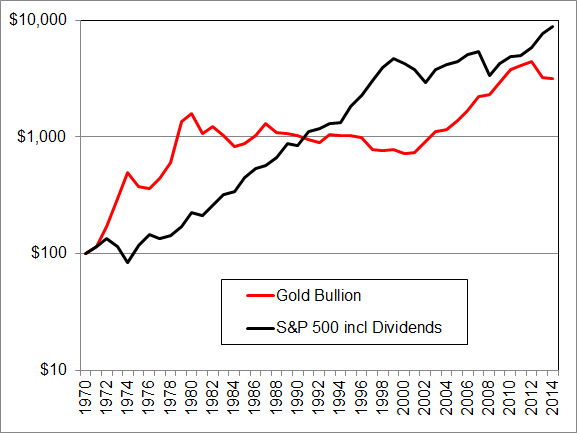

The chart below shows the performance of the US Stock Market (including dividends) and the performance of gold bullion from 1970 thru 2014. I used Robert Shiller's Earnings per Share and Dividends per share from 1970 thru 1987 and the Earnings per Share and Dividends per share that are published by S&P after 1987. Prices for gold after 1969 were taken from usagold.com.

From 1970 thru 2014

Gold returned 3,055% and the S&P 500 including dividends returned

8,695%

What’s noteworthy here is that the period shown in the chart above contained some of the

most severe shocks to the US and global economy (the recession of 1973-1974, the Great

Inflation of the 1970s, the bursting of the Tech Bubble in 2000 and the global financial

crisis of 2008), but stocks still outperformed gold during the

entire period. Furthermore, stocks more or less rose steadily, but that is certainly not

true of gold. Once again, gold will almost certainly outperform stocks during critical

periods of economic uncertainty, but the real question is:

What’s gonna happen next?

If the global economy continues to improve, then stocks will almost certainly outperform.

If the global economy is tested with another disaster of epidemic proportions, then gold will almost certainly outperform.

A Brief Modern History of Gold

From 1492 to 1600 less than 23 million ounces of gold were mined throughout the world. In the 18th Century the New World’s mines accounted for 80% of world production which was 48 million ounces. Most of the mining was done by indigenous or African slaves.

By 1994, total world production was approaching 50 million ounces annually. Of this, South Africa produced more than 30 million ounces - six times more than the former USSR, which is the next largest producer. Canada, the US, and Australia (in that order) are the next largest producers. The extensive gold reefs of the Witwatersrand in the Transvaal and similar deposits in the Orange Free State made South Africa the greatest gold producing area in the world. The gold bearing reef extends from the surface in some areas to far below the surface. Most of the surface gold has been removed, and gold in this area is now obtained from deep underground mines at great expense.

During 1994-98 central bankers were dumping gold and many South African mines were closed because at $300 or so per ounce, gold could not be mined profitably. The miners (mostly indigenous Africans) were sent back to their homelands with lump sum payments as high as $2,800 after thirty years of service.

It may be interesting to compare the actions of the central bankers who were dumping gold to the CEOs of contemporary US companies who were actively buying back shares of their companies at 1998’s prices i.e., why weren’t the bankers dumping gold when it cost $800 an ounce and why weren’t the CEOs buying when the DOW was at 700? This is noteworthy only because it emphasizes that the "Masters of the Universe" are no more prescient than the average investor who typically buys high, and sells low.

During the summer of 1999 gold fell to about $250 an ounce when bankers announced they were going to dump as much as 100 tons per year on the market in the future. Later they recanted and gold shot to well over $300 per ounce as the shorts scrambled to cover their positions. What’s really noteworthy here is how a small supply change can affect the price. To put this into perspective recognize that India, a poor country with a per capita GDP of $300, bought 800 tons of gold in 1998. That’s one gram of gold per person. If everyone in the world decided to buy one gram of gold per year it would amount to about 6,000 tons, or more than two times the 1999 supply of newly mined gold.

Consider the November 1999 fundamentals of gold. All the gold in the world amounts to about 120,000 tons worth about $1.3 trillion. Contrast this to the world’s stock market capitalization which is over $25 trillion. In 1999 the world’s gold mines produced about 90 million ounces or about 2,600 metric tons (1 metric ton = 2204.6 lbs.). What’s troubling here is that 1999 production was almost double that of 1994.

The Economist called gold's 2003 ascent a sucker's rally: The world's central banks hold about 30,000 tons of gold in their vaults but they're not buying more. Indeed, the long term outlook for gold might mirror the fate of silver. A century ago, banks hoarded silver, but now silver is worth what it was at the beginning of the 19th century. By this measure, if banks were to abandon gold, it would be worth about $68 an ounce. Will they? Nobody knows, but I have learned that The Economist is no better at predicting the future than any other human.

It seems that producers are finding cheaper ways to mine gold. In the third quarter of 2004, Newmont was mining gold in Indonesia at a cash cost of about $115 an ounce; in Peru, $140; in Uzbekistan and Turkey, $170; in New Zealand, $205; in Australia, at varying sums from $225 to $310; and in Nevada, $290. These figures reflect varying currencies, wage levels and ore quality as well as geology. Non-cash operating costs, mainly depreciation, add $30 to $60 to all these figures. The average quoted cash cost to produce gold in 2005 was about $340 per ounce. These costs include depreciation, amortization, reclamation, and mine closure costs.

By 2005, South Africa was once again the largest gold producer in the world. In 2005, 2,518 tons were mined, and South Africa produced 12% of the total. The best estimate is that 155,500 tons have been mined throughout history. About 64% has been produced since 1950.

Miguel Perez-Santalla, the vice-president of marketing at W.C.Heraeus Precious Metals, believes the average production cost of gold during 2010 will be between $400 and $500 per ounce. Head-quartered in Hanau, Germany – and earning €1.8 billion from product revenues in 2008 against €12.9 billion from precious metals' trading – W.C.Heraeus employs almost 5,000 staff. Its gold refining capabilities in Germany and Hong Kong both meet the London Bullion Market Association's strict requirements for "Good Delivery" status, the benchmark for professional dealers and investors worldwide.

Buying Gold

There are at least two ways to buy gold; gold and precious metals stock and/or funds and gold bullion or gold coins. To date, I’ve limited myself to Vanguard Gold and Precious Metals Specialized portfolio but began to question this strategy after reading an article by John Markese in the AAII Journal in which he stated that if you’re going to buy gold you’re better off buying bullion. His reason is that gold stock behaves as gold does in a bull market i.e., it goes down and gold stock behaves as stock does in a bear market i.e., it goes down. According to John, you can’t win with gold stock.

It’s January 2010 and I have not yet purchased gold bullion. Gold bullion was priced at $288 per ounce when I first recommended Vanguard Gold and Precious Metals in December 1997. At the end of 2009 it was priced at $1,087.50 per ounce. If you had purchased Gold Bullion in December 1997 you’d have a total return of about 275% (excluding storage and transaction costs); if you had purchased Vanguard Precious Metals you’d have had a total return of 536%, but Vanguard Precious Metals lost more than half its value during 2008. It will be interesting to see what happens next.

According to the Internal Revenue Service's 2010 Instructions for Schedule D (Capital Gains and Losses), Gold Coins and Bullion are collectibles. The IRS makes no distinction between a foreign or domestic Gold Coin, or a foreign or domestic collectible.

According to the IRS, collectibles include works of art, rugs, antiques, metals (such as gold, silver, platinum bullion), gems, stamps, coins, alcoholic beverages, and certain other tangible property.

Uncle Sam takes a tax bite out of almost every asset sold and collectibles are no exception. Indeed, collectibles are currently subject to one of the highest rates of federal taxation on investment property. The capital gain from the sale of a collectible is taxed at 28 percent.

After January 1, 2012, it became more difficult to evade these taxes because precious metals and coin dealers are now required to report the sale of gold coins and bullion to the Internal Revenue Service on Form 1099s. Sales of gold coins are not always reported to the IRS by coin dealers because some coin dealers claim some gold and some silver coins are exempt from Form 1099s reporting requirements. That implies that if the sale is not reported, then you won't have to pay taxes, but you may want to check with a friendly IRS agent or tax attorney before you decide to commit a felony by failing to report income.

The Form 1099s reporting requirement, intended to mine what the IRS deems a vast reservoir of uncollected income tax, was included in the health care legislation ostensibly as a way to pay for it. The tax code tweak is expected to raise $17 billion over the next 10 years, according to the Joint Committee on Taxation.

There are several other problems with coins and bullion:

Problem #1. If you purchase coins, bullion, jewelry etcetera, you should demand a certificate of purity or authenticity from a reputable dealer. However, when you're selling as an individual, you are NOT a reputable dealer. That means the purchaser may require a new certificate of purity or authenticity from a reputable assayer. Obviously, that could erode your profit or increase your loss.

Problem #2. Some folks buy gold coins and bullion because it gives them pleasure to look at it and fondle it. Unless you live in a secure fortress, it is probably not a good idea to keep more than a few dollars worth in your insecure home for reasons that should be obvious.

For the record, my Vanguard Precious Metals Fund is less than 3% of my total stock portfolio and I have no intention of changing that allocation by a significant amount. FYI, Burton G. Malkiel, author of A Random Walk Down Wall Street, recommends putting about 5% of a total portfolio into gold.

Henry Wirth - December 1997

Revised Sep 1998, Nov 1999, Jan 2002, Jun 2002, Jan 2004, May 2004, Jan 2005, Jan 2006, Jan 2007, Feb 2008, Jan 2009, Jan 2010, Jan 2011, Jun 2011, Jan 2012, Jan 2013, Dec 2013, Jan 2015 & Jan 2016