Sentiment Survey

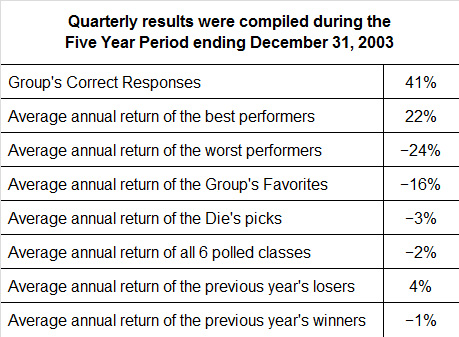

This survey was taken during the monthly meeting of a Financial Planning Group at the end of each quarter from 1998 through 2003. An average of about 20 participants contributed their opinions every quarter.

The first question was: Will the S&P 500, including dividends, return more OR less than 15% over the next 12 months? If the future is anything like the past hundred years, then the chance of answering correctly is about even.

Next members were asked if the NASDAQ 100, US Intermediate Term Bonds, Developed Europe, the Developed Pacific, or Emerging Markets will out or under-perform the S&P 500 over the next 12 months.

The Group's Favorite was the asset class that received the most votes.

A die was then rolled to determine if the die could pick a winner with better results than the Group's Favorite.

Why take a Sentiment Survey?

• To accurately determine what the group collectively believes is going to occur in the future.

• To determine precisely how accurate the group’s collective predictions were and to identify individuals who may be able to accurately predict future events.

• To examine the consequences of investing according to the dictates of our emotions or sentiments and to learn the limits of our abilities to predict the future.

Over the period for which results are available no one was able to consistently predict the future. This should be obvious, but many people believe they can predict the future.

Normal humans call this wishful thinking; cognitive psychologists call this "hindsight bias" i.e., the tendency to believe we knew all along what was going to happen, when in fact we had no such foresight.

You can easily play this game yourself, but if you do, remember to record your forecasts.

"The palest ink is better than the best memory."

If you're any better at it than the group, then let me know.

Frequently sentiment surveys are used as contrarian indicators i.e., extreme bullishness signals a market top, and extreme bearishness signals a market bottom. In fact, it's not quite as easy as that; if it were then it would have been documented a long time ago. In the real world, sentiment surveys are no better at predicting the future than examining the entrails of a chicken were when our ancestors lived in caves.